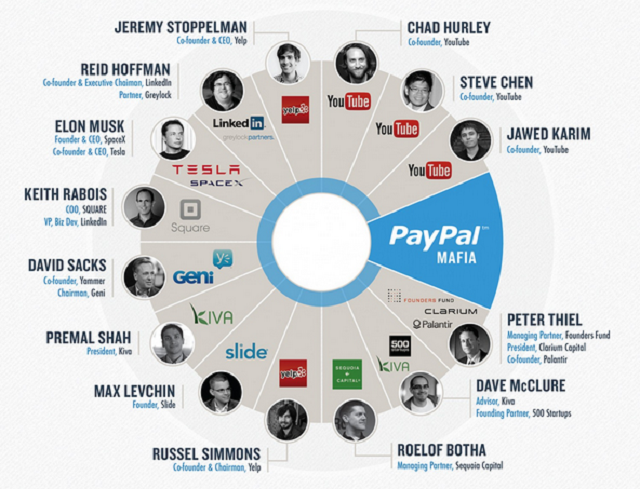

“There was this big vacuum, Silicon Valley was going through a nuclear winter,” Rabois says. Rabois pinpoints this as the moment the mafia was made: the smart people and the smart money had left tech, leaving the crew of PayPal outcasts as the only team in town. Musk was already gone, and when Thiel quit, many followed. Rabois says that in one three-hour meeting, when Sacks flicked through a 120-page slide show ahead of schedule, “you could see the look of horror on their faces”. “ very much slow, cautious and consensus driven. It was one of the first big deals in the aftermath of the crash, and made PayPal’s founders rich and miserable at the same time.Įric Jackson, a former PayPal marketing executive, said there was an instant clash between PayPal’s leaders and Meg Whitman, eBay’s chief executive. The $1.5bn it paid is now small change but in 2002 it rocked the tech world. PayPal, survived, unlike many start-ups at the time, but changed when eBay, the auction website where PayPal had first spread, came knocking. “The company was a catastrophic mess, Elon had been fired and it was burning $10m a month in a market where you couldn’t raise additional capital.” Rabois was hired in 2000, shortly after Thiel had replaced the ousted Musk as chief executive and in the middle of the tech crash. The combined company settled on the name PayPal, but in other respects was defined by a “creative confrontational style”, says Keith Rabois, now a partner at Thiel’s investment firm Founders Fund. Thiel and Levchin had stuffed Confinity with acquaintances from Illinois and Stanford universities, creating a competitive atmosphere in its early days that only became more so when it merged with Musk’s online banking start-up x.com in early 2000, the peak of the dotcom bubble. “It’s not like this was seen as a very attractive group to belong to… were misfits.” “We kind of laugh that people portray us as this very powerful group today, it’s really just this group of friends that came together,” says Sacks, who was the company’s chief operating officer. Sacks says the image of the clutch of employees becoming the elite would have been preposterous 20 years ago, when Confinity, as the company was then known, launched PayPal, a way to send money over the internet. In turn, Yammer was backed by Thiel and Levchin. Sacks, a venture capitalist, has invested in two of Musk’s ventures, SpaceX and The Boring Company, as well as Thiel’s data analytics company Palantir and Levchin’s Affirm. Since the “PayPal mafia” term was coined by Fortune magazine in 2007 (amplified by a striking photo shoot in which 13 of the group dressed as mobsters), they have only become richer and more revered. Today, the roughly two dozen members continue to finance one another, sit on each other’s boards, and work at each other’s companies. The family also includes Tesla’s Elon Musk, LinkedIn’s Reid Hoffman, and the founders of YouTube, Yelp and Palantir.

His consigliere and co-founder Max Levchin backed the likes of Stripe and Pinterest. Its don, Peter Thiel, PayPal’s former chief executive, was the first outside investor in Facebook, and remains one of tech’s most powerful venture capitalists. Sacks is one member of the “PayPal mafia”, the network of the first employees at the payments company who have gone on to enjoy immense wealth and influence in the tech industry. This Cosa Nostra does not go around breaking windows, but in Silicon Valley, it is just as notorious. It was later bought by Microsoft for $1.2bn. Sacks went on to found Yammer, a social network for offices. But as one big screen mobster famously said, just when you think you’re out, they pull you back in. The dotcom bubble had burst, and Sacks could have put his tech days behind him. The result, 2005’s Thank You For Smoking, became a sleeper hit, and returned its $10m budget many times over. When David Sacks left PayPal, shortly after eBay paid $1.5bn (£1.2bn) for the company in 2002, the first thing he did was finance a movie. The so-called 'PayPal mafia' represent the best, worst, and most controversial aspects of Silicon Valley

0 kommentar(er)

0 kommentar(er)